There is a much quoted quip from James Carville that he would like to be reincarnated as the bond market because “you can intimidate everyone.”

I think it is important to note that Carville said that during Bill Clinton’s tenure in 1994. By the end of the decade the USA was retiring the 30-year bond amid large budget surpluses.

From that perspective maybe the bond market was correct to rein in the worst spending inclinations of the political class.

President Obama’s administration had a similar experience when the Federal Reserve began its quantitative easing program in response to the credit crisis.

President Trump was spared a revolt from the bond market in response to his tax cuts in 2017. Then the initial money printing in response to the pandemic did not draw fire from bond investors either.

That must have lulled politicians into the false conclusion that the bond market had been conquered.

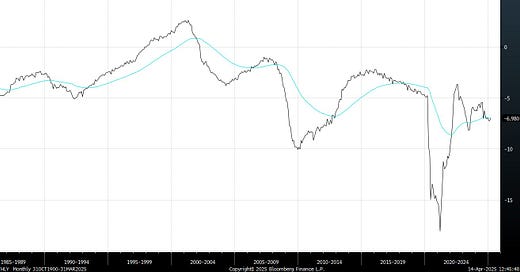

The massive run-up in yields from early 2022 should have dissuaded them of the belief that excessive deficit spending could continue unchecked.

The violent response of the bond market to the imposition of tariffs on all of the USA’s trading partners, friend and foe alike, suggests vigilantes are back in action.

The promise that DOGE can find massive savings, that tariffs will miraculously cover government spending or that the war in Ukraine will end swiftly are all untested themes.

There is no question that the Trump administration reacted swiftly to the jump in Treasury yields. That was the catalyst for the 90-day delay and the carve out of electronics from the China tariffs.

As a result, Treasuries yields were lower today. That might be seen as a reward from the bond market for good behaviour.

This begs the question what now for tariffs?

Shuli Ren at Bloomberg offered an interesting tidbit in an article over the weekend.

After all, Bessent, who’s now spearheading tariff negotiations, requires a stable bond market to sell into. His department needs to issue roughly $2 trillion in new debt this year, in addition to rolling over about $8 trillion in maturing bonds. Every 1% rise in yield would cost the government around $100 billion.

By this logic, the 10-basis point decline today, saved the US government $1 trillion. That is still a lot of money even with a depreciating Dollar.