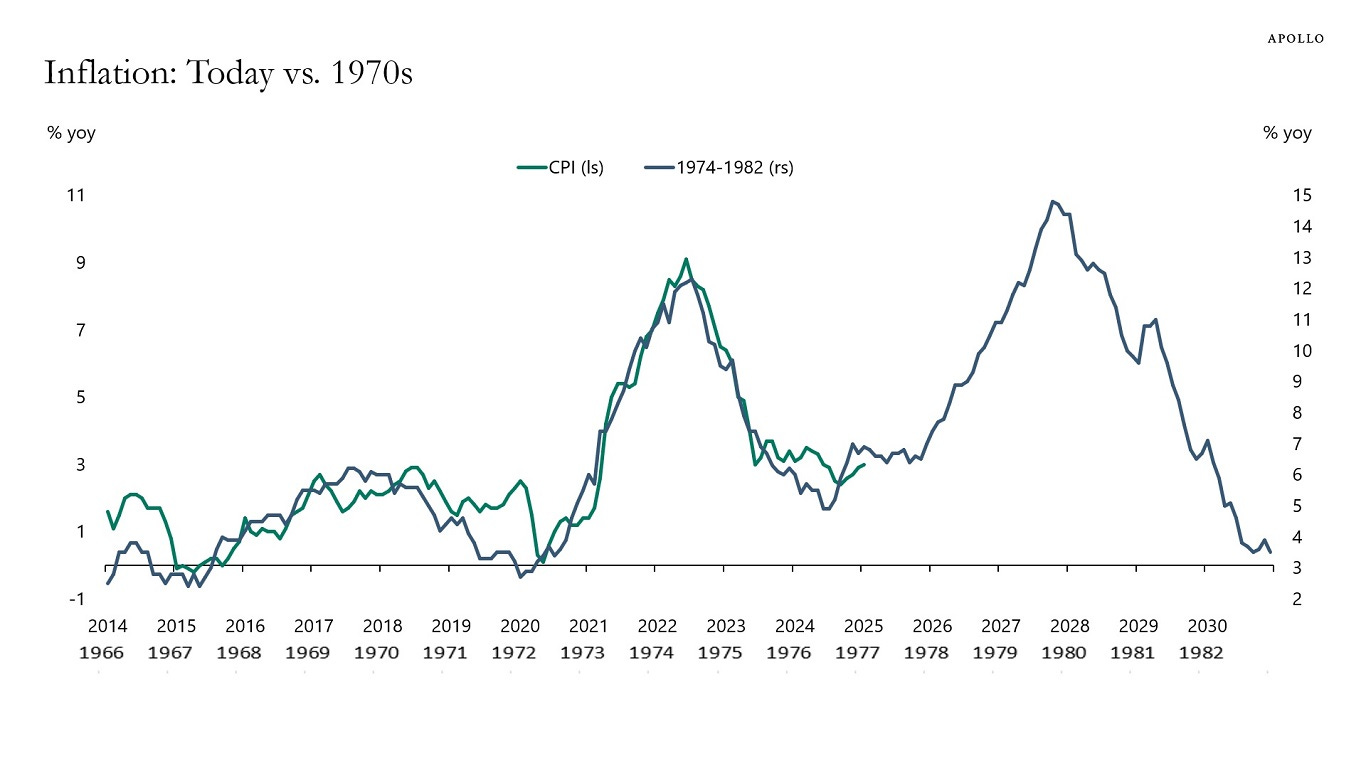

Are We Seeing A Rerun Of The 1970s?

This graphic by Torsten Slok for Apollo highlights how the current inflation trend bears an uncanny resemblance to the experience of the 1970s.

Given the length of time the chart covers we will not have confirmation a new uptrend has been avoided until some time in 2027.

The supply chain issues and the massive combined monetary and fiscal stimulus of the pandemic seeded the inflation surge.

That begs the question what would be required to ignite the next one?

The clearest answer is that the fiscal stimulus is still ongoing.

The US government is running multi-trillion dollar deficits. So far, the market is giving Elon Musk and his team of young programmers at the Department of Government Efficiency the benefit of the doubt.

If they succeed it would be a great victory for fiscal responsibility. There is also the possibility it will fail in dramatic fashion.

With the 2017 tax cuts due to be extended and several other giveaways planned, closing the deficit is going to be challenging.

There is also the real possibility that the tariffs planned on almost every one of the USA’s trading partners will seed another inflationary episode.

There is plenty of evidence to suggest businesses use tariffs to support their margins. That kind of price gouging also supports inflation expectations.