Does Copper Represent The Ideal For What The US Government Expects From Tariffs?

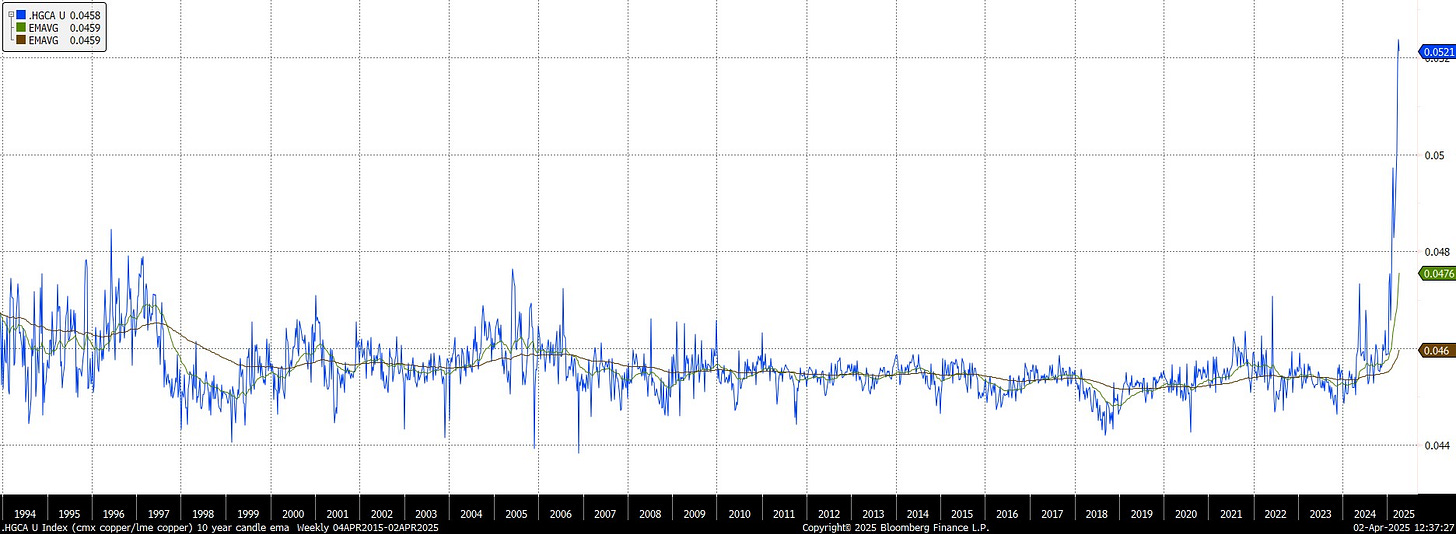

The price of copper on Comex is currently trading at almost a 15% premium to the price on the London Metals Exchange.

The initial speculation was that that tariff rate would be set at 25%. The market has gone about half- way in pricing in that potential.

How the spread performs in the coming days will obviously be influenced by what the official tariff rate turns out to be. How the price performs will be influenced by the knock-on effects of the tariffs.

Ensuring US manufacturers will pay a significant premium for the copper they consume does not sound like good business.

It won’t be unless there is a material change to how much copper is produced domestically at an economic rate.

Even in a benign scenario, this represents a significant input cost increase for businesses. It is likely to persist for several years, or until tariffs are dropped.

The market will respond in several different ways.

The first instinct will be for businesses to pass on the cost increase to consumers. Some will successfully raise prices by the full 25%, even though that significantly overstates the impact from input costs rising.

Others will not be in as strong a position to raise prices and will try to have producers absorb some of the impact from tariffs. Companies like Costco, Wal-Mart and Target are hoping to push tariffs costs onto suppliers for example. Metal fabricators will attempt the same thing if they experience push back from consumers.

Consumers are already buying vehicles ahead of the imposition of tariffs. That’s a demand centre for copper. However, once that bump in sales is complete, consumers will not be in a hurry to trade up.

Producers of copper face some significant challenges. The tariff means the received price will be better than expected. Increasing supply to benefit from that boon is a significant challenge. Much of the USA is hostile to mining projects.

President Trump aims to deploy Cold War era powers to streamline the planning process of developing new mines. He will certainly face legal battles from environmental groups in pursuing that ambition.

Freeport McMoRan is talking about expanding its leaching operation from tailings at its Morenci mine in Arizona. After 154 years of mining there is a great deal of waste to process. So far, they have produced around 100,000 tons of copper and hope to produce 400,000 tons by the end of the decade.

That’s about 80,000 tons a year, for a market that consumes nearly 2 million tons. Several other miners like Rio Tinto and BHP are also investing in expanding their tailings operations. This helps to highlight the magnitude of the challenge. The USA has relied on recycling copper for much of its supply but that work is often done overseas and the supply is finite.

Building new mines is essential but it takes time. The short-term answer is to rely on tailings operations but that is a stop-gap measure at best. The broader challenge is mine grades have declined by 40% since 1991. Even to keep production stable will require significant investment in efficiency gains and new operations.

These are not new issues, so what hasn’t copper surged before now?