In a few hours we will know whether the tariffs announced by President Trump last Tuesday will go into effect.

It is almost certain that the tariffs on China are going to be durable. Those applying to the rest of the world are likely to be more flexible as negotiations get underway.

Traders are currently in a sell first and ask questions later mood.

In practice that means they are receiving margin calls and will sell whatever they have a profit in.

The recent downward pressure on bitcoin and gold are perfect examples of that predicament even though neither is affected by tariffs.

Let’s take a step back and think about what is going on and how it applies to gold.

The USA is inviting stagflation.

The tariffs will certainly increase the price of imports. That will both put pressure on prices and deter demand. That is both inflationary and will sap growth which is the definition of stagflation.

Right now, consumers are loading up on iPhones, olive oil and European wine. The jump in demand could produce a surge of economic activity. However, with the tariffs potentially going into place tomorrow, the effect will be negligible relative to the hit demand will take when prices rise.

The UK’s scheduled jump in stamp duty has provided a good example of how this type of activity affects markets.

Anyone thinking of buying a house has a good reason to get it done before that tax hike. That pulls demand from the future into the present which means there will be fewer buyers after taxes rise.

When inflation is high and growth is low, bonds do not do well. 10-year bond prices dropped sharply on Monday and followed through on the downside on Tuesday. That is raising the cost of funding for the US government.

Aside from the heavy press coverage of the tariffs, let’s not forget that the primary aim of the Republican administration is to cut taxes. As bond yields rise that is becoming a challenging question. Without significant savings the tax cuts will be very difficult, if not impossible, to push through Congress.

Against this background the US dollar has been quite steady against majors like the Euro, and Pound. It is strengthening against commodity currencies like the Australian Dollar and weakening against safe havens like the Swiss Franc and Japanese Yen.

This currency market volatility is supporting the gold price even as it unwinds a short-term overbought condition. I have been warning for several weeks that some consolidation was to be expected and that is currently underway.

Medium-term, gold benefits when the trend of real rates is falling. That has been the case since the beginning of the year and the recent weakness coincided with a jump in the rate.

Nevertheless, the only way the US government is going to get out from under its debt pile is to inflate it away. The purchasing power of the US Dollar is going to continue to fall. That’s a long-term boost for gold as a store of value.

Meanwhile the stock market remains under pressure and gold is outperforming in robust fashion.

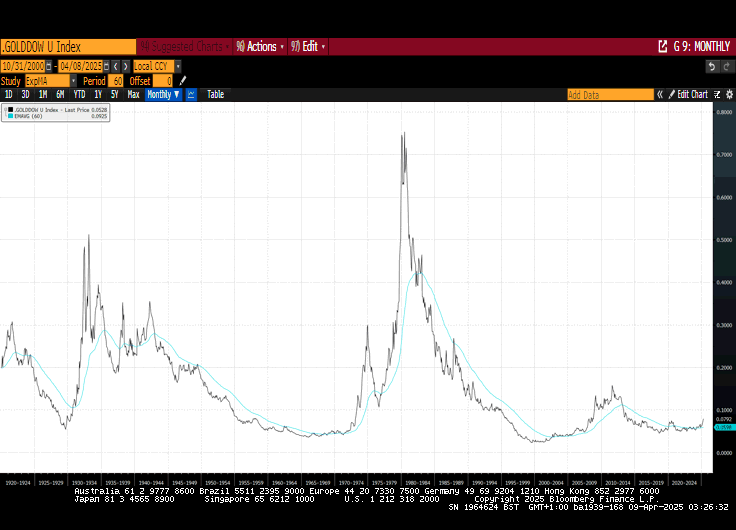

The Gold/Dow ratio hit a new 11-year high on Tuesday. I chose to highlight this version of the ratio because it clearly shows how low gold is relative to stocks. That is a clear message that the stock market is overvalued.