How Long Is The Hong Kong Dollar Going To Be Around For? Smucker Suffers, Zuckerberg & AGI

How Long Is The Hong Kong Dollar Going To Be Around For?

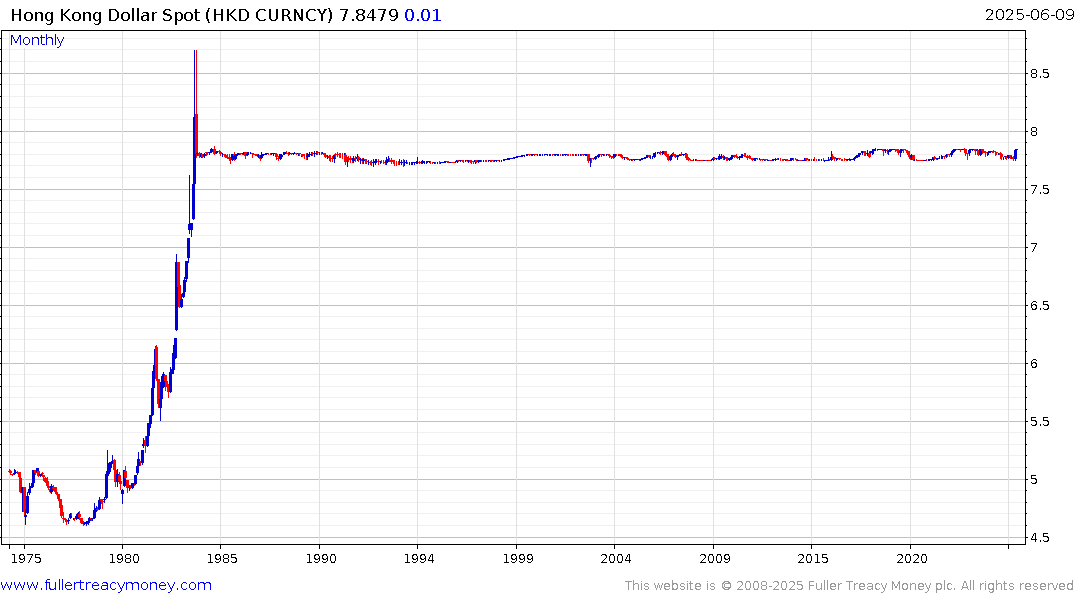

Hong Kong’s peg to the US Dollar was introduced in 1983. That followed a deep decline that saw the currency lose more than half its value in less than 3 years.

Nations do not introduce pegs by choice. It is usually because of a crisis. In Hong Kong’s case, several banks had Dollar liabilities and the depreciating currency was a major headache. By pegging the currency the risk of further deterioration was eliminated.

Following the introduction of the peg, the Hang Seng embarked on an epic rally. It jumped from a low of 713 in 1983 to a peak just below 4000 before the crash in 1987.

Over the last forty years Hong Kong has offered a destination for traders to play the arbitrage between US interest rates and Asian/Chinese growth rates. That has contributed to several boom and bust cycles.

Hong Kong was handed back to China in 1997. The passage of the security law in 2020 removed any question about whether Hong Kong’s autonomy would continue to be tolerated by the Chinese government.

That begs the question whether there is a continued need for the Hong Kong Dollar to exist?

It is still being used as a destination to test interest rate arbitrages.

For example, Hong Kong overnight rates are currently 0.2%, while the USA’s are 4.33%. That is an odd set of circumstances considered the pressure to sustain the peg.

The rate has returned to test the upper side of the official band near HKD7.85. In order to create demand the Hong Kong Monetary Authority may need to sell US Dollars or raise rates.

There has been significant speculation over the years about when China will act to remove the Hong Kong Dollar from circulation. That would mean moving the peg to the Renminbi and confiscating the HKMA’s reserves.

It is a potential outcome that needs to be weighed against the risks to China’s standing if it pursued.