Interest Expense Is Major US Headache

Commodity Indices bottoming, China's economic centre of gravity

Correction: I contacted Shuli Ren at Bloomberg to confirm the number I quoted from her article in yesterday’s commentary. The impact of a 1 basis point move in yields for the US government should be $1 billion not $100 billion.

This is a case of trust but verify, and I did not verify. That does not negate the sensitivity of the US administration to lurches in the Treasury market, although it certainly changes the calculus.

$100 billion per basis point sounded high. The issue in today’s world is the volume of cash being spent every year is truly mind boggling.

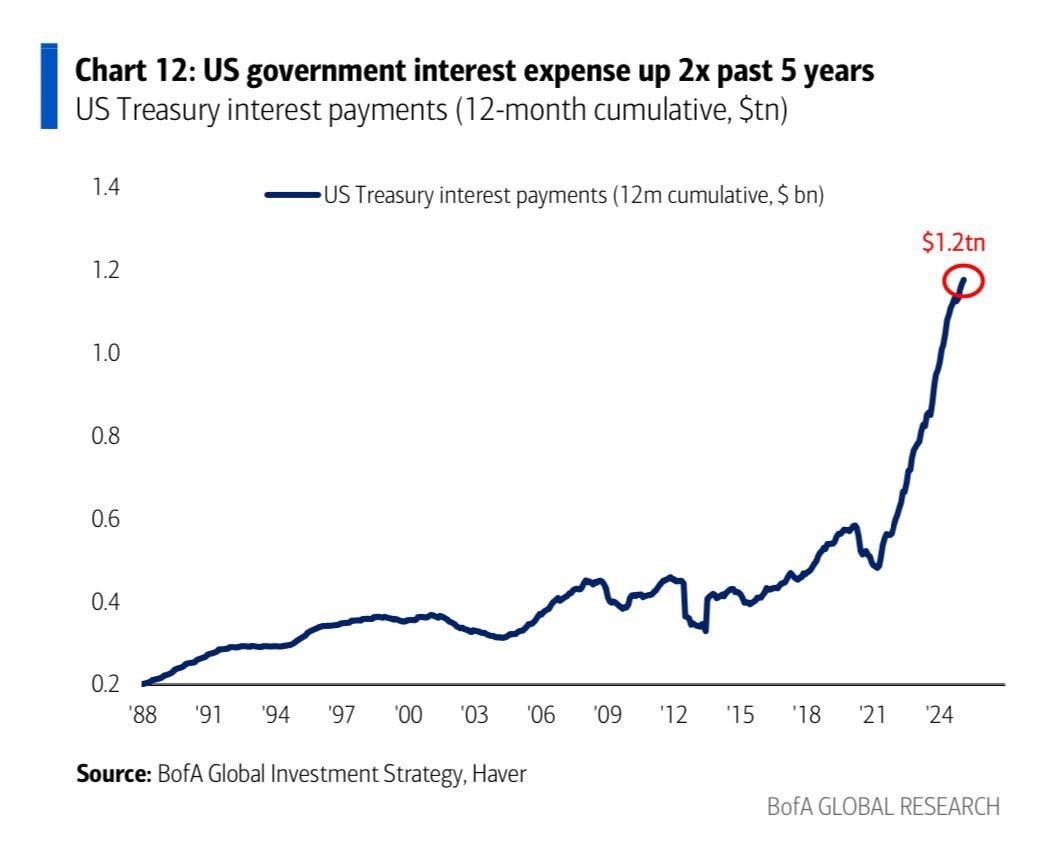

This chart from Bank of America depicts the total value spent on servicing the US national debt updated to the end of last year. It is a stunning depiction of how the blow up in borrowing costs, as well as the acceleration in demand from social programs, has become the government’s largest line item.

The Trump administration is fully aware of the issues presented by this condition. The efforts to raise cash from tariffs, cutting regulations at home, reducing energy costs and reducing military outlays, while simultaneously looking to cut taxes is very ambitious.

Today’s talk of introducing an additional higher tax bracket, for those earning more than $1 million, reflects some of the challenges with passing the budget on that basis.