Reflex Trader weekly update - Stagflation risks rise but we are still in an inflationary boom

Welcome over to the FullerTreacyMoney family. I look forward to serving you here on Substack.

For new subscribers and pre-subscribers who are receiving these missives for the first time, Reflex Trader is primarily focused on seasonal trades. The most significant of these is the Payday Strategy.

The strategy is based on the simplest of ideas but it is backed with solid statistical data. Some days really are better than others. This is because over 70 million workers in the USA have 401(k) pensions and get paid every two weeks.

That represents a withdrawal from pay cheques every two weeks which is invested in the financial markets. That’s two repeatable, predictable inflows of new money to the market every two weeks.

Concurrently, there are inflows at the end of one month and the beginning of the next that also boost activity. Funds rebalance at the end of the month and the end of the quarter. That also new money coming into the market.

Statistically, the market is more likely to rally during the Payday windows of opportunity. It just so happens that some of the biggest advances in market history have occurred during the Payday windows.

What is perhaps even more interesting is that most of the worst days in the market’s history have fallen outside of the Payday Windows.

If you had only owned the Dow Jones Industrials Average during the Payday windows, you outperform the wider market over the long term. If you only owned the market outside the windows and deliberately avoided the Payday schedule, you would have lost around 90% of your money.

The only way to trade these movements is with futures. Spread-betting is a handy alternative for UK traders which is why I launched this service there. Here is a link to the promotional pdf from 2023.

It is important to understand that spread-betting is inherently risky and highly leveraged. You can lose more than your initial stake. The biggest mistake rookie traders make is in taking too large a position for their available capital.

You need to budget for three consecutive losing trades that are stopped out at 1000-point loss where you still have sufficient funds to trade if you are going to participate fruitfully with the strategy.

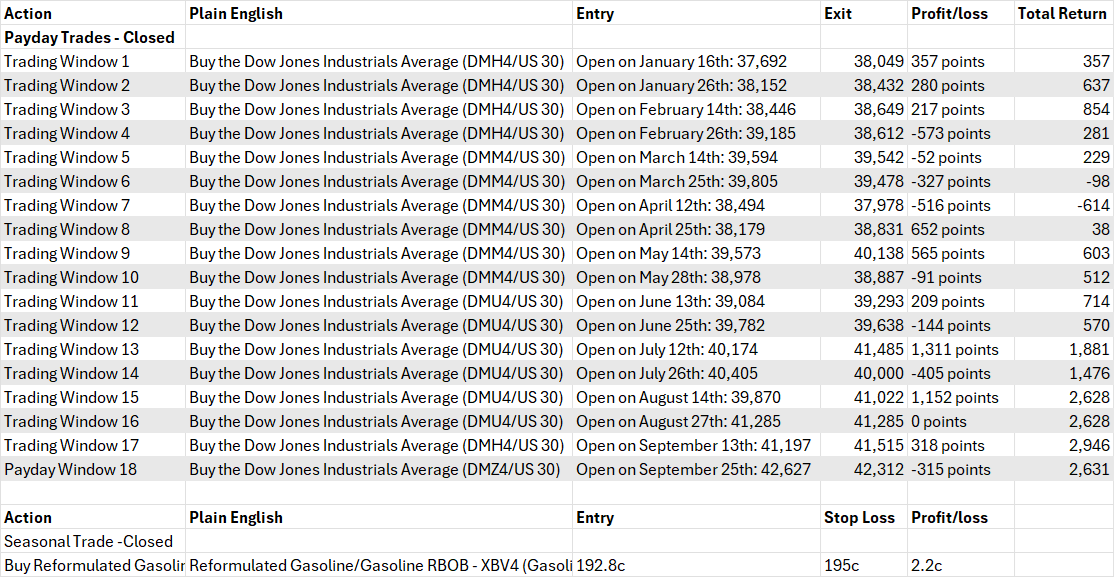

In 2023, the strategy generated 3952 points of profit. So far this year, the strategy is ahead by 2631 points.

We trade the Dow Jones Industrials Average because it has enough points to make the moves meaningful and enough variation to not be dominated by one sector. The good news is it is still in an uptrend.

The next window opens on Monday at the US opening bell and will close with market on Friday. This is a somewhat longer mid-month window to allow for the Columbus Day holiday.

Let’s consider the macro background.