Yield Curve Analysis

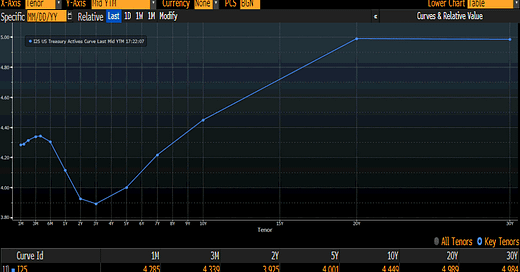

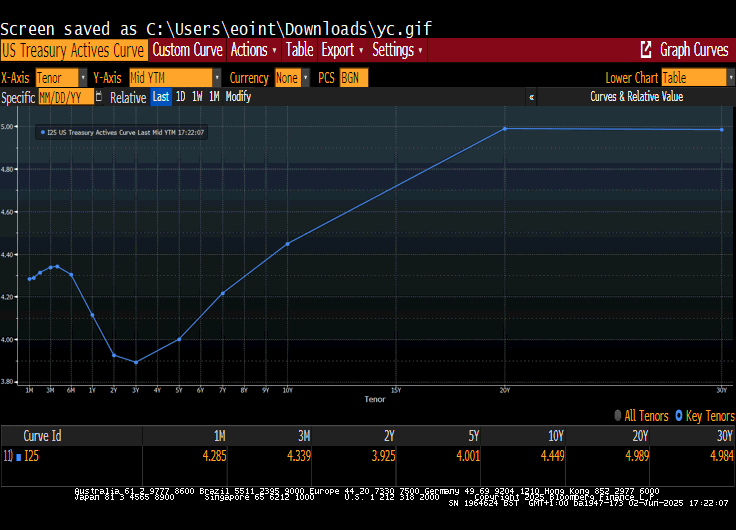

Take a look at the chart below. It represents the US Treasury yield curve. Every point on the chart represents the yield at a given maturity.

There are two important phenomena evident in the bond market at present that are worth considering.

The first is the yield on the 20-year and the 30-year are almost identical. Some of the reasons for that condition are because of the choice the Treasury makes in what maturities they issue at.

Nevertheless, any reasonable investor is not going to tie up their cash for 30 years at the same rate as for 20 years, unless they have a very strong view about lower future inflation.

Right now, big bond investors like Pimco and DoubleLine are refusing to buy very long-term debt maturities. They are worried about the impact of runaway deficits on the sustainability of the USA’s government debt.

They are the public face of the bond vigilantes. Their actions should put upward pressure on the long end of the curve which would lead to a steeper trend.

These are also exactly the kind of market movements that tends to chasten politicians.

Ambitious spending plans, that are not adequately funded, do not stand up to scrutiny from bond investors and they refuse to fund them. This is particularly relevant as the US Senate begins to debate the merits of the big beautiful tax bill passed by the lower house.

The second big takeaway is there is a significant belly in the curve either side of the 3-year maturity.

The normal shape of the curve goes from bottom left to upper right. That reflects the rational demand for a higher yield, the longer the maturity.

When the yield is lower in 3 years than it is at present it suggests the market is expecting one of two possible scenarios.